Anqa Compliance

Anqa Compliance is a regulatory compliance software that helps streamline AML and KYC processes for financial institutions..

What is Anqa Compliance?

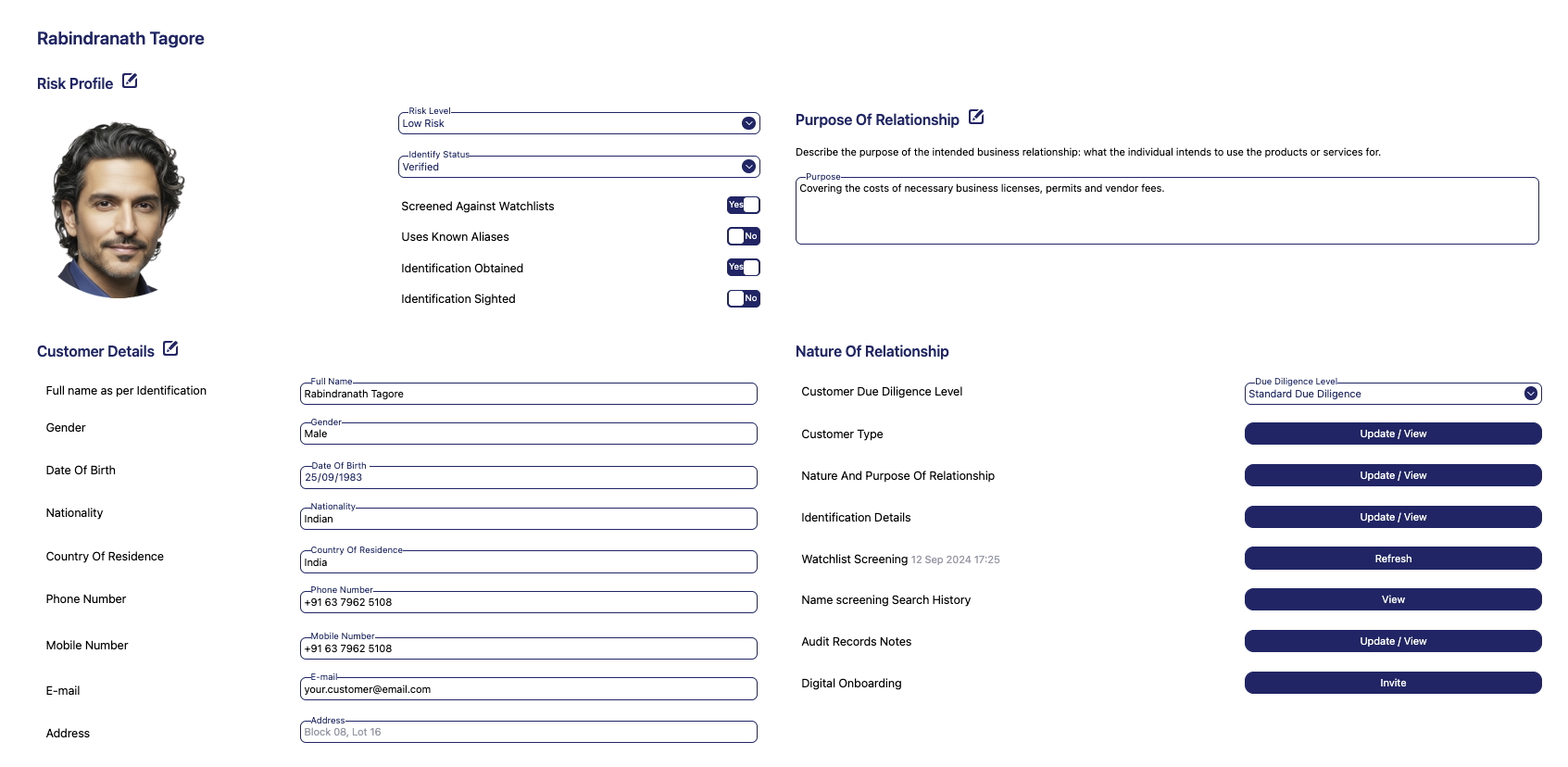

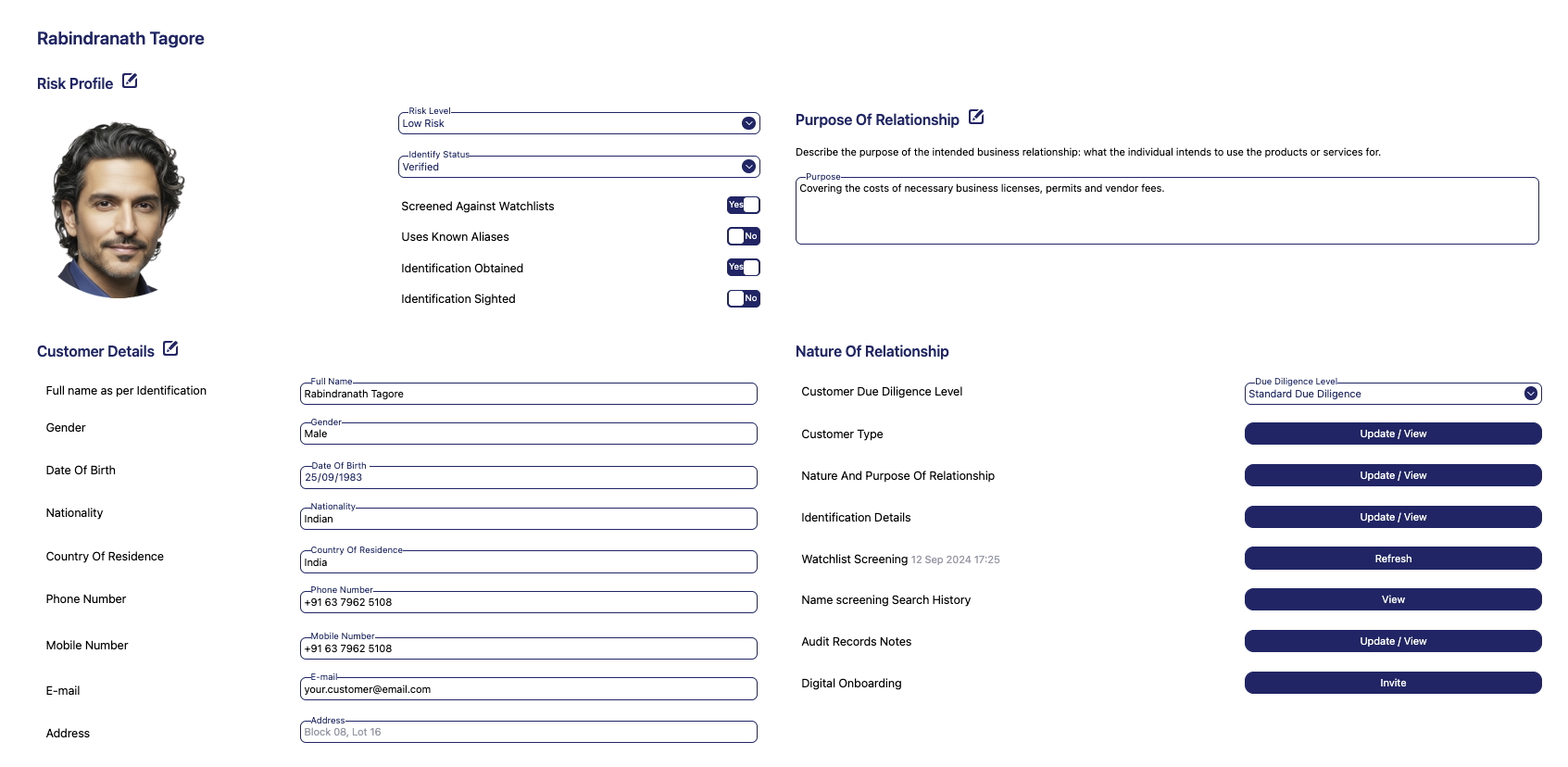

Anqa Compliance is a global AML, KYC, and sanctions platform connecting eight powerful modules in one intelligent system. Institutions and professionals from banks, fintechs, and remittance firms to lawyers, real-estate agents, accountants, and gaming operators use Anqa to see risk clearly and act fast. Modules include Sanctions Screening, KYC Hub, Digital Onboarding, Risk Assessment, Transaction Monitoring, Crypto Investigator, Case Management, and Loan Assessment. Integrated intelligence means your screening informs monitoring, risk scores guide investigations, KYC data flows into every decision, and crypto analysis exposes blockchain risk that others can t see. Built for affordability and accessibility worldwide, ANQA delivers enterprise power and street-level simplicity helping every business meet compliance obligations with confidence.

Screenshots

Video

Categories

Features

FAQ

Anqa Compliance is a global AML, KYC, and sanctions platform connecting eight powerful modules in one intelligent system. Institutions and professionals from banks, fintechs, and remittance firms to lawyers, real-estate agents, accountants, and gaming operators use Anqa to see risk clearly and act fast. Modules include Sanctions Screening, KYC Hub, Digital Onboarding, Risk Assessment, Transaction Monitoring, Crypto Investigator, Case Management, and Loan Assessment. Integrated intelligence means your screening informs monitoring, risk scores guide investigations, KYC data flows into every decision, and crypto analysis exposes blockchain risk that others can t see. Built for affordability and accessibility worldwide, ANQA delivers enterprise power and street-level simplicity helping every business meet compliance obligations with confidence.

Anqa Compliance belongs to the KYC category.

Anqa Compliance offers features such as Compliance Management, Document Management, PEP Screening, Real-Time Monitoring, Risk Management.

No, Anqa Compliance does not offer a free trial.

Pricing

Starting at:

$35/usage based

Free Trial Available

Reviews(0)

Write a reviewAnqa Compliance alternatives

OnBoard

NOW AVAILABLE: OnBoard AI - The Most Advanced Boardroom AI Available Today OnBoard is the leading board management platform purpose built for today s boardrooms to simplify governance, enhance transparency, and elevate director engagement. Trusted by...load more

Plaid

Digital wealth platforms can increase customer lifetime value with Plaid. Fund accounts instantly and securely while unlocking tailored financial advice that helps customers manage cash flow and understand investments.

Sumsub

Sumsub is the one verification platform for all of your AML compliance needs. With Sumsubs customizable KYC, KYB, AML, Transaction Monitoring and Fraud Prevention solutions, you can comply with AML regulations, protect your business and reduce costs ...load more

Shufti

Shufti provides global AML screening against 1,700+ sanctions, PEP, and watchlists, enabling businesses to detect financial crime and meet FATF, GDPR, and global AML compliance standards.

Athennian

Athennian entity data management software is used by hundreds of top law firms and in-house legal teams, to manage all their entity data within a single platform. Athennian is the only modern, cloud-based entity management platform, helping you to ce...load more

Entrust IDV

Onfido, an Entrust company, meets your unique identity verification needs with an end-to-end, AI-powered platform. Simplify identity verification for you and your customer with tailored verification journeys. Choose what you need from our Verificatio...load more

IDfy

IDfy builds technology solutions to help companies accurately identify people, run background checks, conduct KYC, mitigate lending risks, and onboard associates. Our mission is to deliver these solutions with zero friction for end users. Since its i...load more

COMPLY

COMPLY empowers financial services firms to build strong, proactive compliance cultures that go beyond regulatory checklists helping them reduce fines, protect their reputations, retain top talent, and drive business growth. As the leading provider ...load more

Company Watch

Company Watch provides business financial risk management using our powerful H-score®, TextScore®, and Probability of Distress (PoD®), which conduct an in-depth financial health check of a company. Our enhanced due diligence tools offer comprehensive...load more

IPQS

IPQS provides unparalleled fraud prevention solutions by producing the freshest and richest data available. Our advanced APIs and data sets specialize in real-time fraud prevention with unmatched accuracy through our cyberthreat honeypot network. We ...load more