FinCense

FinCense is an end-to-end operating system of anti-money laundering and fraud prevention tools for fintechs and traditional banks.

What is FinCense?

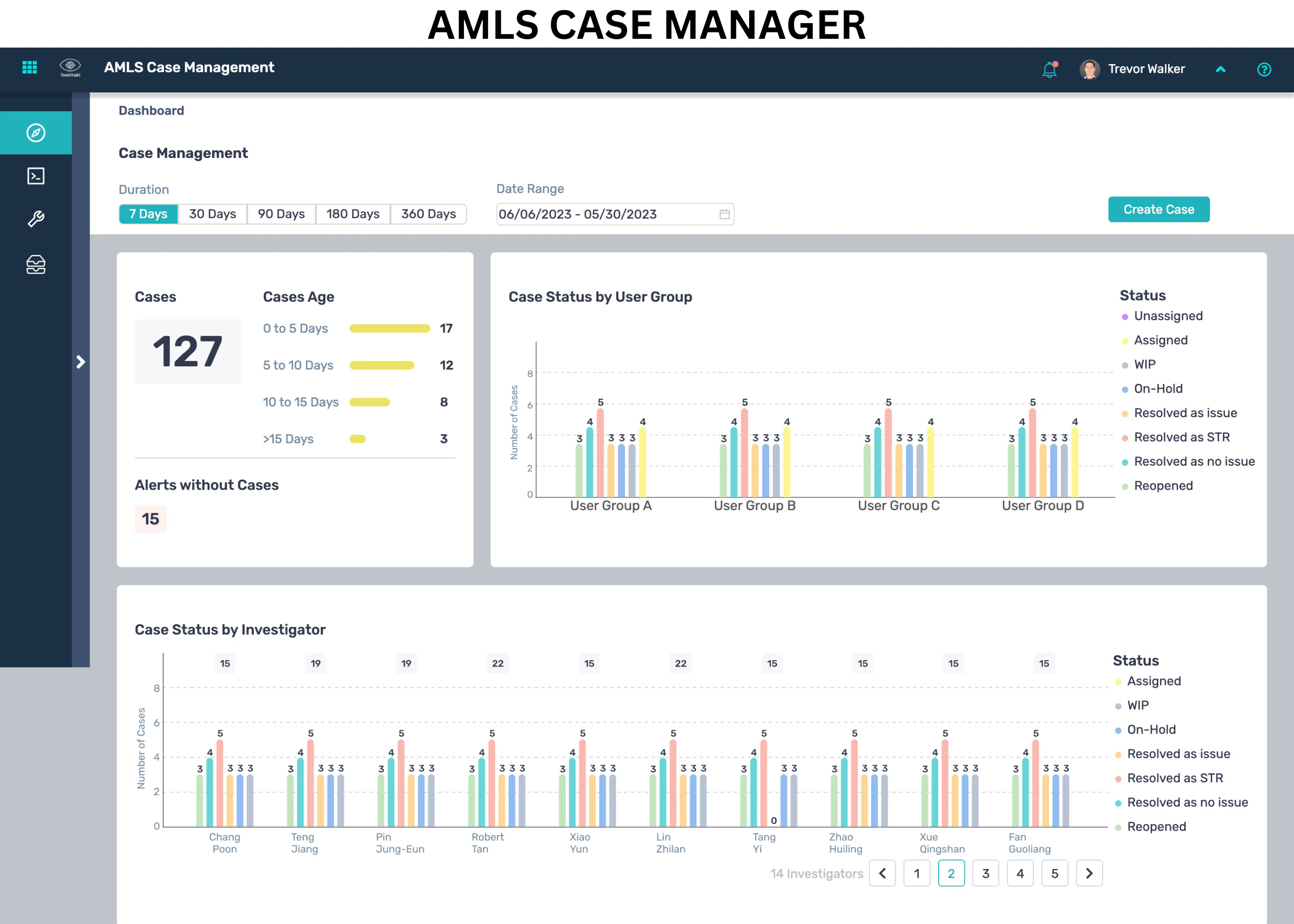

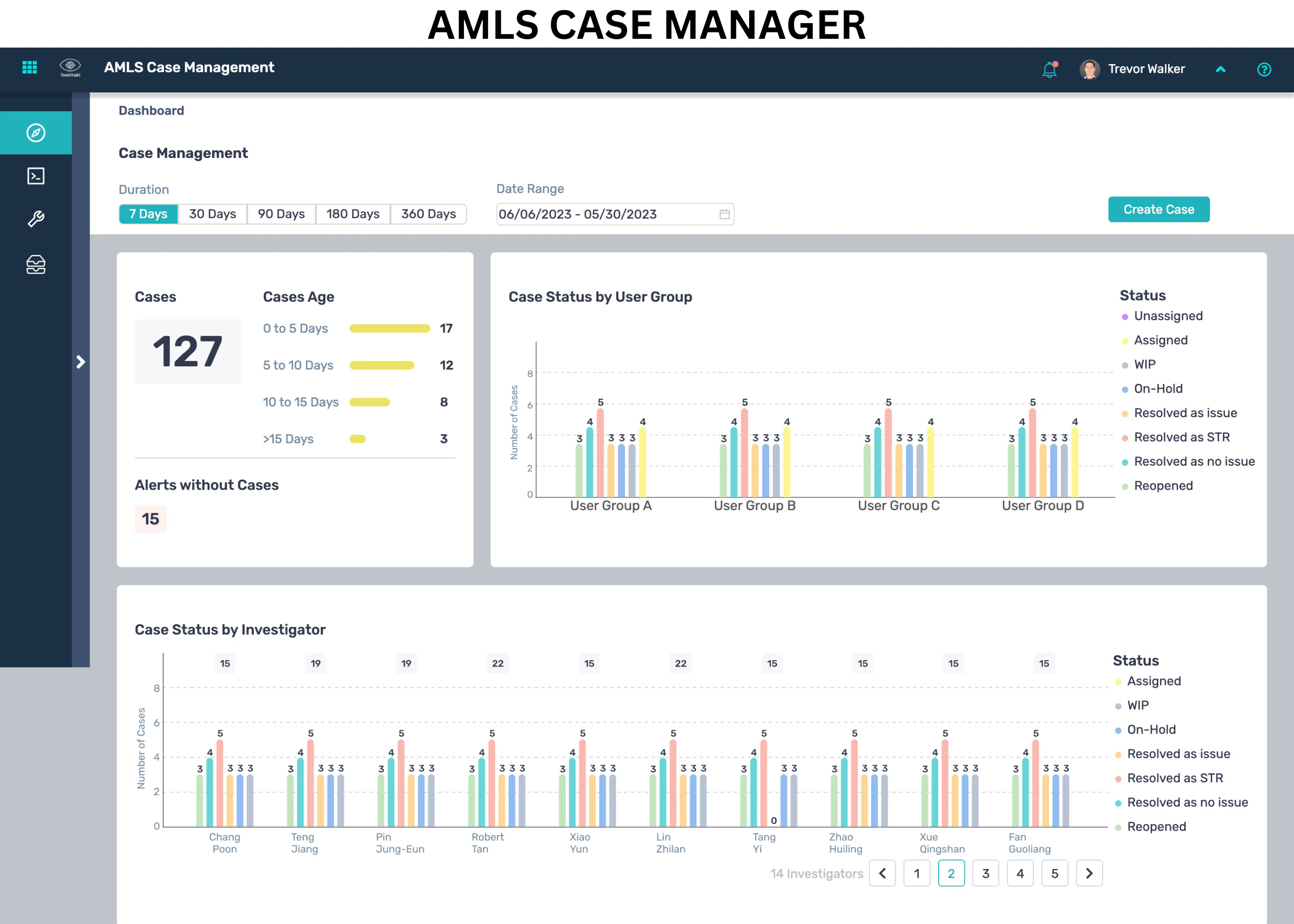

FinCense is an end-to-end operating system of anti-money laundering and fraud prevention tools for fintechs and traditional banks. The FinCense platform is enabled through seamless integration with the AFC Ecosystem. The product utilizes a federated learning model, or a collaborative approach to training machine learning models. Through its federated learning approach, the FinCense model is trained based on real-world crime scenarios identified within the AFC. As a result, FinCense can identify and notify for unique financial crime attacks that often go missed or unanticipated by traditional risk-based financial crime prevention. The FinCense suite is a bundled offering, including several financial crime tools that work together to provide comprehensive risk coverage. These tools include Onboarding Suite, FRAML, Smart Screening, Customer Risk Scoring, Smart Alert Management and Case Manager.

Screenshots

Video

Features

FAQ

The official website of FinCense is https://www.tookitaki.ai/

FinCense is an end-to-end operating system of anti-money laundering and fraud prevention tools for fintechs and traditional banks. The FinCense platform is enabled through seamless integration with the AFC Ecosystem. The product utilizes a federated learning model, or a collaborative approach to training machine learning models. Through its federated learning approach, the FinCense model is trained based on real-world crime scenarios identified within the AFC. As a result, FinCense can identify and notify for unique financial crime attacks that often go missed or unanticipated by traditional risk-based financial crime prevention. The FinCense suite is a bundled offering, including several financial crime tools that work together to provide comprehensive risk coverage. These tools include Onboarding Suite, FRAML, Smart Screening, Customer Risk Scoring, Smart Alert Management and Case Manager.

FinCense belongs to the AML, Financial Fraud Detection, KYC category.

FinCense offers features such as Behavioral Analytics, Case Management, Compliance Management, Compliance Tracking, Fraud Detection, PEP Screening, Reporting/Analytics, Transaction Monitoring, Watch List, Check Fraud Detection, Custom Fraud Rules, Customer Accounts, For Banking, Address Validation, Document Management, Identity Verification, Real-Time Monitoring, Risk Management.

Reviews(0)

Write a reviewFinCense alternatives

PayPal

PayPal helps businesses manage digital payments, invoicing, and mobile transactions across eCommerce and service workflows. Its most used by marketing, IT services, and retail teams. Reviewers highlight its mobile access and real-time alerts, but pri...load more

OnBoard

NOW AVAILABLE: OnBoard AI - The Most Advanced Boardroom AI Available Today OnBoard is the leading board management platform purpose built for today s boardrooms to simplify governance, enhance transparency, and elevate director engagement. Trusted by...load more

authorize.net

Authorize.net is a payment processing solution. It helps businesses accept credit cards, eCheck, and digital payments. Businesses can accept payments online, in person, via mobile devices, and over the phone. The platform caters to a wide range of in...load more

Tipalti

Tipalti helps SMBs automate accounts payable workflows, especially payment processing and vendor onboarding. Its most used by small businesses in marketing and finance roles. Reviewers highlight global payment support and approval workflows, though s...load more

ProcessGene GRC Software Suite

ProcessGene develops forward-thinking GRC software solutions, designed to serve multi-subsidiary organizations. The company has been acknowledged as a market leader and innovator by the most important analyst firms. Businesses and governments worldwi...load more

PayPal Enterprise Payments

PayPal Braintree is a cloud-based platform for businesses that helps manage payment processing needs. It caters to a wide range of businesses, from startups to large enterprises, offering tools to facilitate online and mobile payments. It supports mu...load more

Kount

Powered by its Identity Trust Global Network , Kount, An Equifax Company, links billions of trust and fraud signals to protect every interaction from account creation and login to payments and disputes. Businesses use Kount to increase approval rates...load more

LogicGate Risk Cloud

LogicGate's Compliance solution streamlines controls and regulatory compliance management by dynamically connecting controls, risks, assessments, regulations, obligations, exams, and evidence all in one platform, helping organizations save time, redu...load more

Plaid

Digital wealth platforms can increase customer lifetime value with Plaid. Fund accounts instantly and securely while unlocking tailored financial advice that helps customers manage cash flow and understand investments.

Sumsub

Sumsub is the one verification platform for all of your AML compliance needs. With Sumsubs customizable KYC, KYB, AML, Transaction Monitoring and Fraud Prevention solutions, you can comply with AML regulations, protect your business and reduce costs ...load more