FISCAL

FISCAL Forward is statement spreading and financial analysis software, with Global Cash Flow & Credit Memos for small business lending.

What is FISCAL?

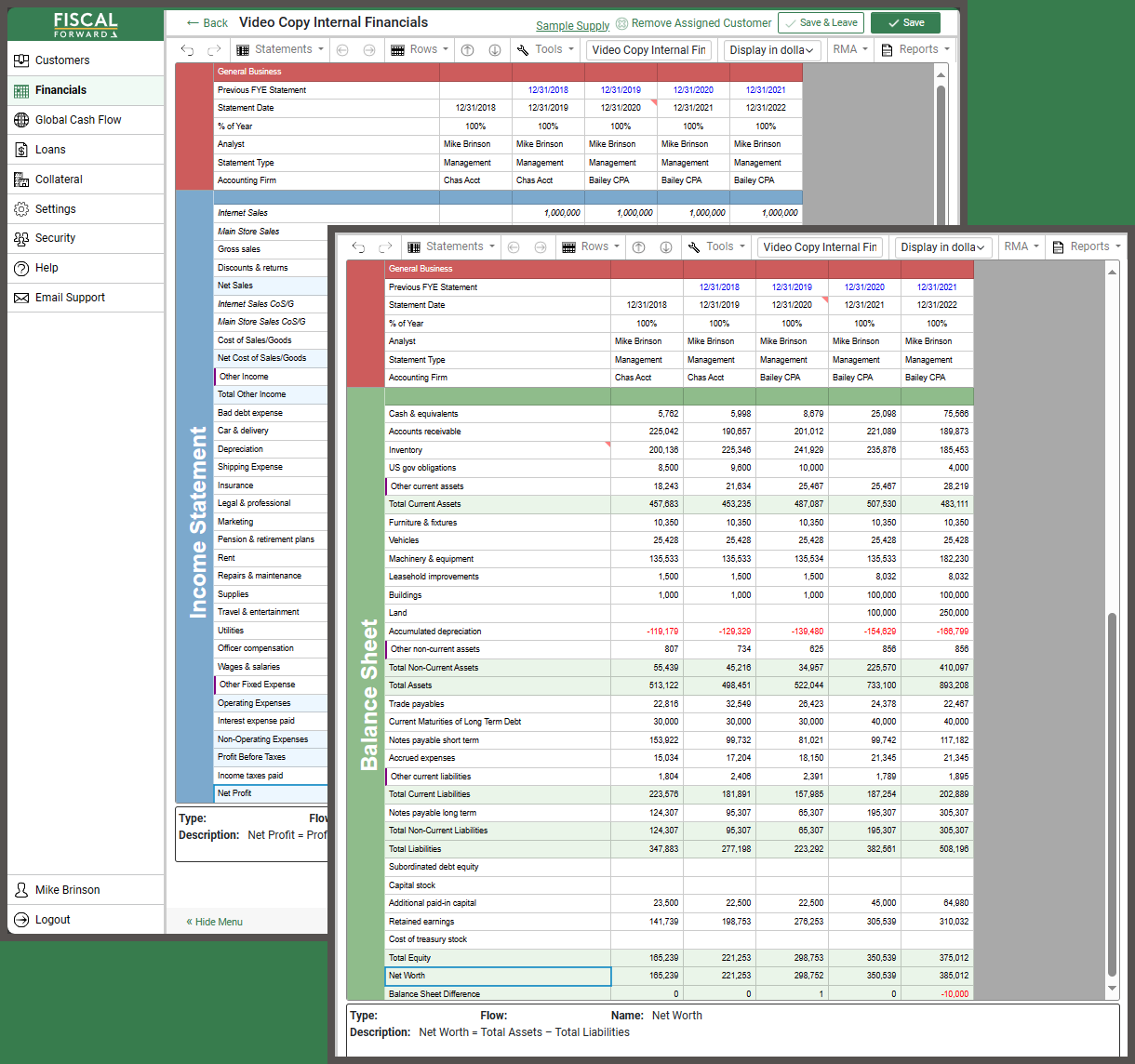

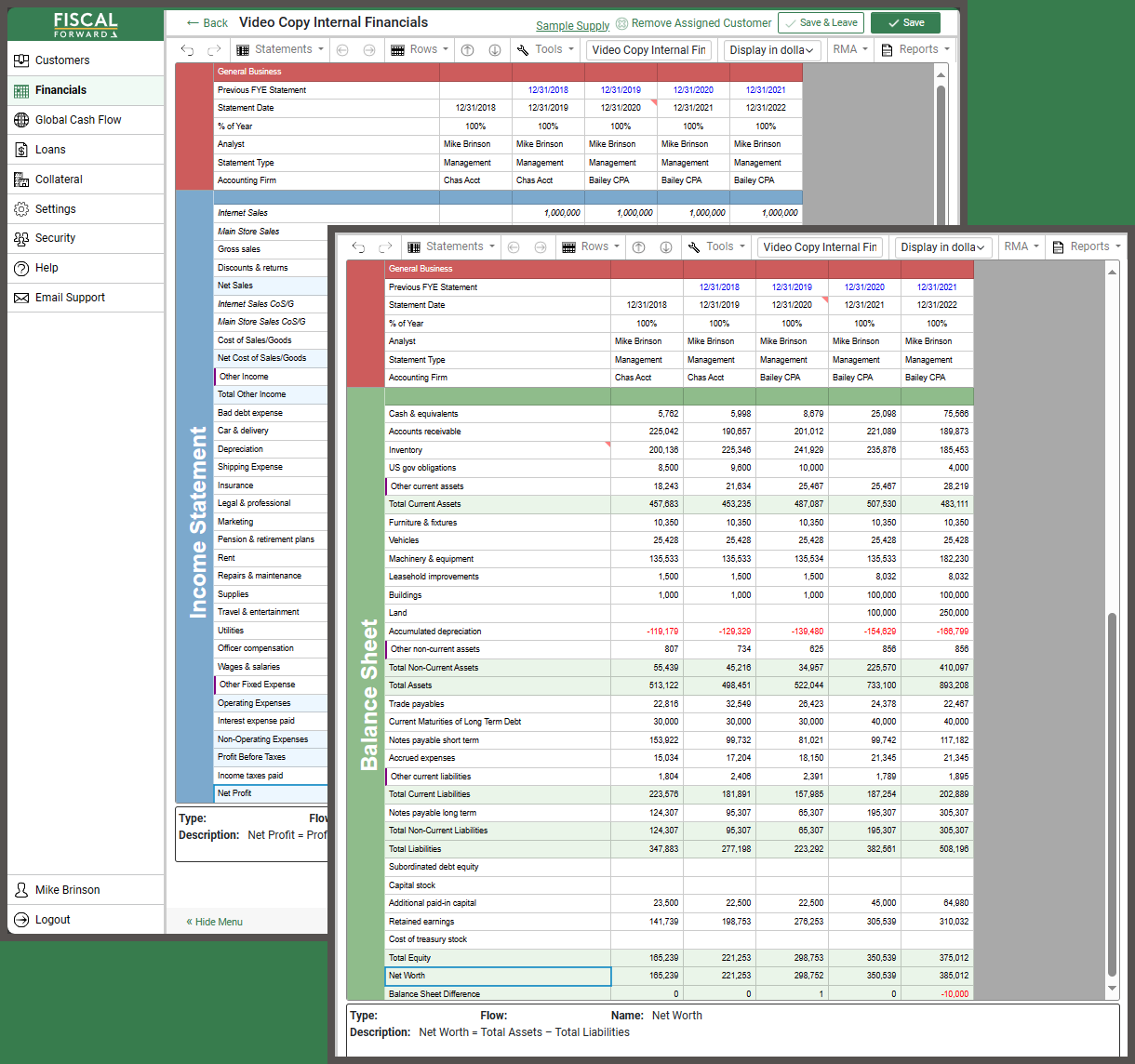

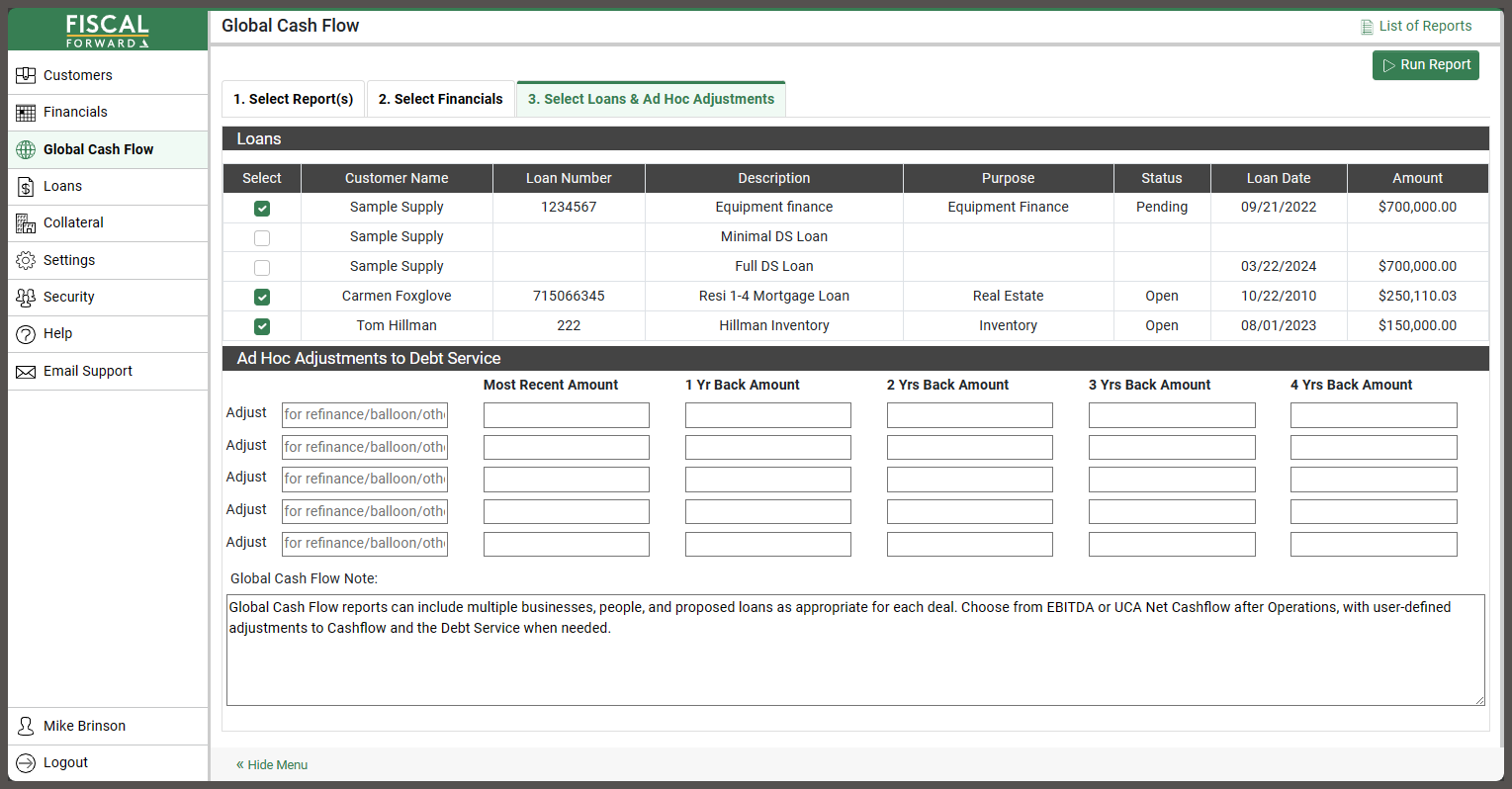

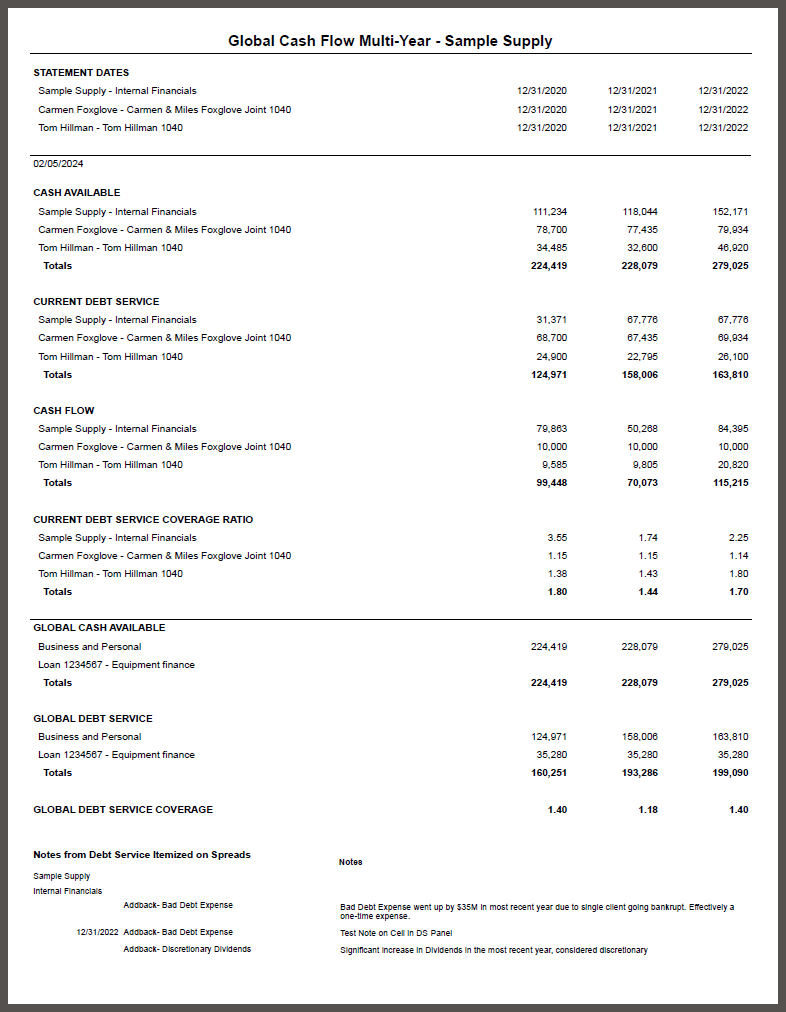

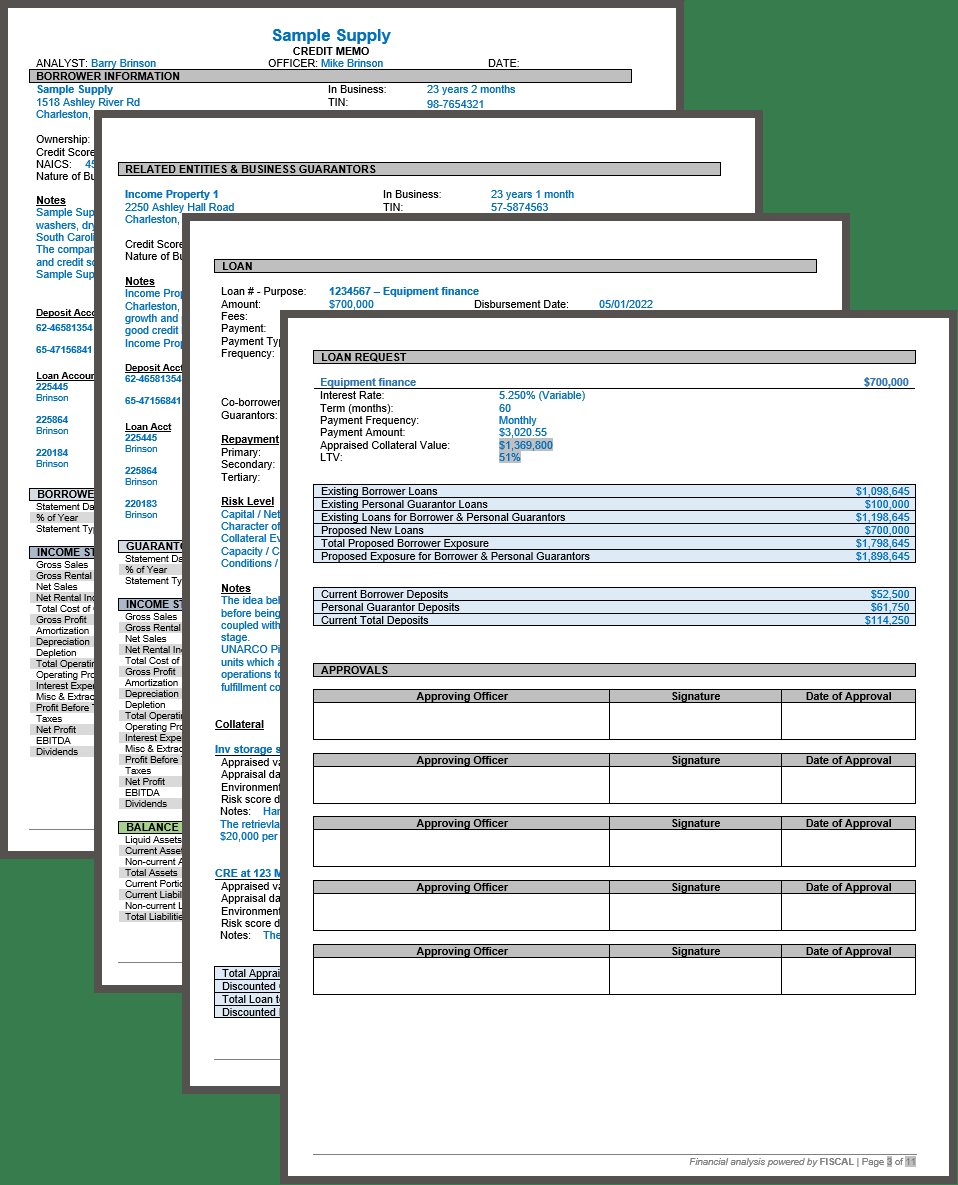

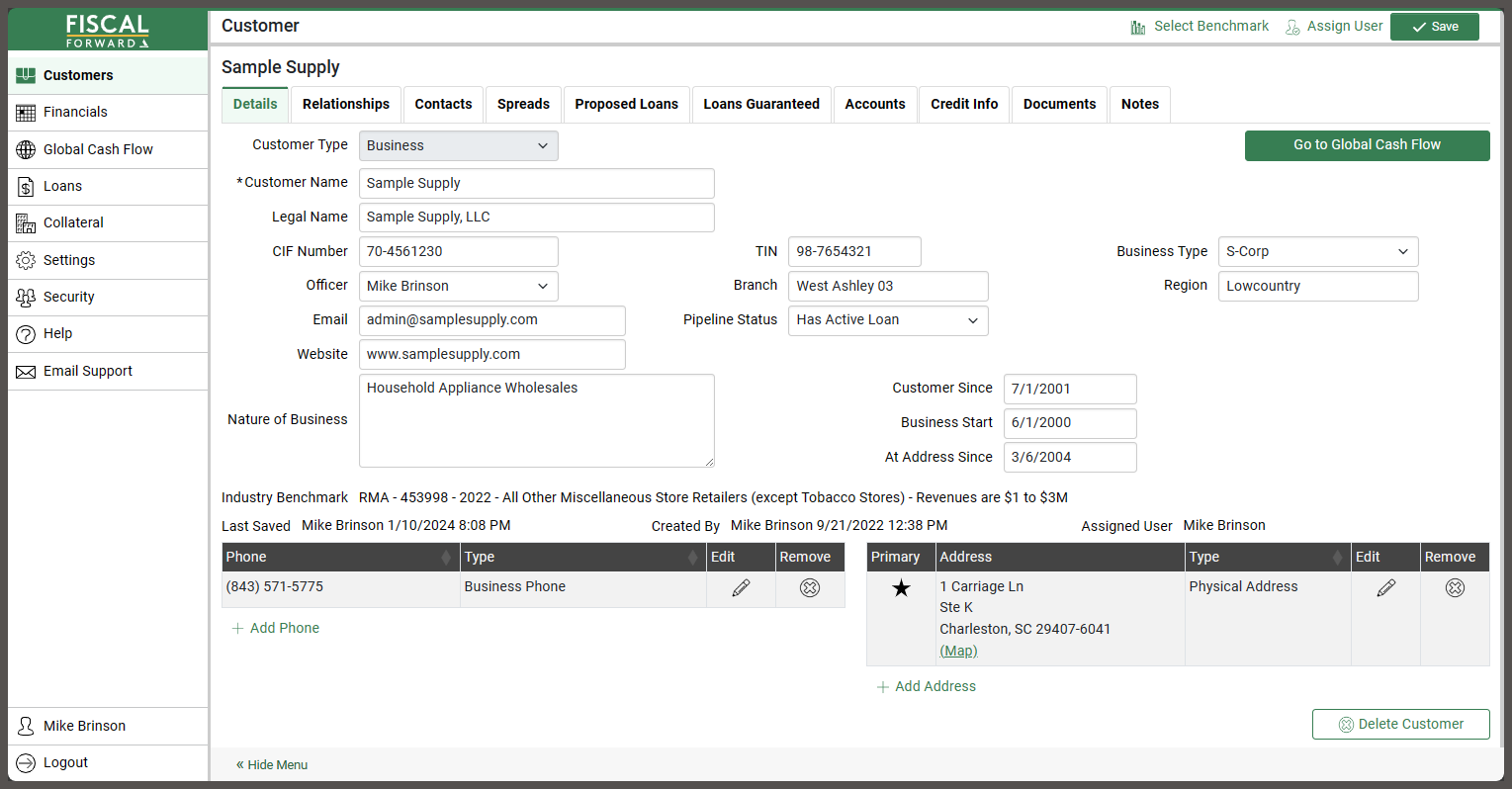

FISCAL Forward is credit analysis software built for small business lending in community banks and credit unions. With standardized Tax Return and Financial Statement spread templates; consistent reports; and a flexible process throughout, FISCAL empowers you to move beyond Excel spreading. Don t get forced into rigid, big-bank processes that don t work for you. Get the Financial Analysis, Global Cash Flow, DSCR reports, and Word-based Credit Memo you need without the burden of a full LOS.

Screenshots

Features

FAQ

The official website of FISCAL is https://www.fiscalcs.com/

FISCAL Forward is credit analysis software built for small business lending in community banks and credit unions. With standardized Tax Return and Financial Statement spread templates; consistent reports; and a flexible process throughout, FISCAL empowers you to move beyond Excel spreading. Don t get forced into rigid, big-bank processes that don t work for you. Get the Financial Analysis, Global Cash Flow, DSCR reports, and Word-based Credit Memo you need without the burden of a full LOS.

FISCAL belongs to the Banking Systems, Commercial Loan, Loan Origination category.

FISCAL offers features such as Compliance Tracking, Lending Management, Portfolio Management, Risk Management, Third-Party Integrations.

No, FISCAL does not offer a free trial.

Pricing

Starting at:

$4000/per year

Free Trial Available

Reviews(0)

Write a reviewFISCAL alternatives

Branch

Branch enables businesses to accelerate payments to their workforce with our comprehensive workforce payments platform. Companies turn to Branch to empower workers with tools like instant payments, free earned wage access, and cashless tips/mileage r...load more

REACH

REACH helps teams manage digital signage across locations with remote display control, playlist scheduling, and layout customization. It popular with small businesses and enterprise teams in education and recreation. Users value its time-saving tools...load more

The Mortgage Office

The Mortgage Office is the most trusted loan management software platform, empowering lenders of all sizes for 45+ years. From private lenders to municipalities to non-profits and educational institutions, The Mortgage Office delivers the most innova...load more

Online Check Writer

Online Check Writer helps small businesses manage check printing, payroll, and payment workflows with minimal setup. Its popular with finance and admin teams in construction and IT. Reviewers highlight its ease of use and customizable checks design, ...load more

Lendio

Getting paid on time should be easy and stress-free. Join the 50,000 companies that have taken billing and invoicing to the next level. Capterra's official review: Easiest-to-use billing and invoicing software for small business! 5/5 stars Capterra r...load more

authorize.net

Authorize.net is a payment processing solution. It helps businesses accept credit cards, eCheck, and digital payments. Businesses can accept payments online, in person, via mobile devices, and over the phone. The platform caters to a wide range of in...load more

ProcessMaker

ProcessMaker's low-code intelligent automation platform empowers organizations to design business processes in secondsno experience necessary. ProcessMaker effortlessly automates mission-critical processes, capitalizes on the next generation of AI-po...load more

Tipalti

Tipalti helps SMBs automate accounts payable workflows, especially payment processing and vendor onboarding. Its most used by small businesses in marketing and finance roles. Reviewers highlight global payment support and approval workflows, though s...load more

Qonto

Qonto makes day-to-day banking easier for SMEs and freelancers, thanks to an online business account combined with invoicing, bookkeeping, and spend management tools. With an innovative product, highly responsive 7/7 customer service, and clear prici...load more

AP Workflow Automation

acompay allows companies to go 100% Paperless with the whole Accounts Payable process from vendor invoices all the way to vendor payments. Reduce invoice processing costs by 75%-85%. In addition our unique Paperless Pay offer eliminates 100% of the c...load more