RapidAML

RapidAML is AML software that streamlines compliance with screening, KYC, and transaction monitoring features.

What is RapidAML?

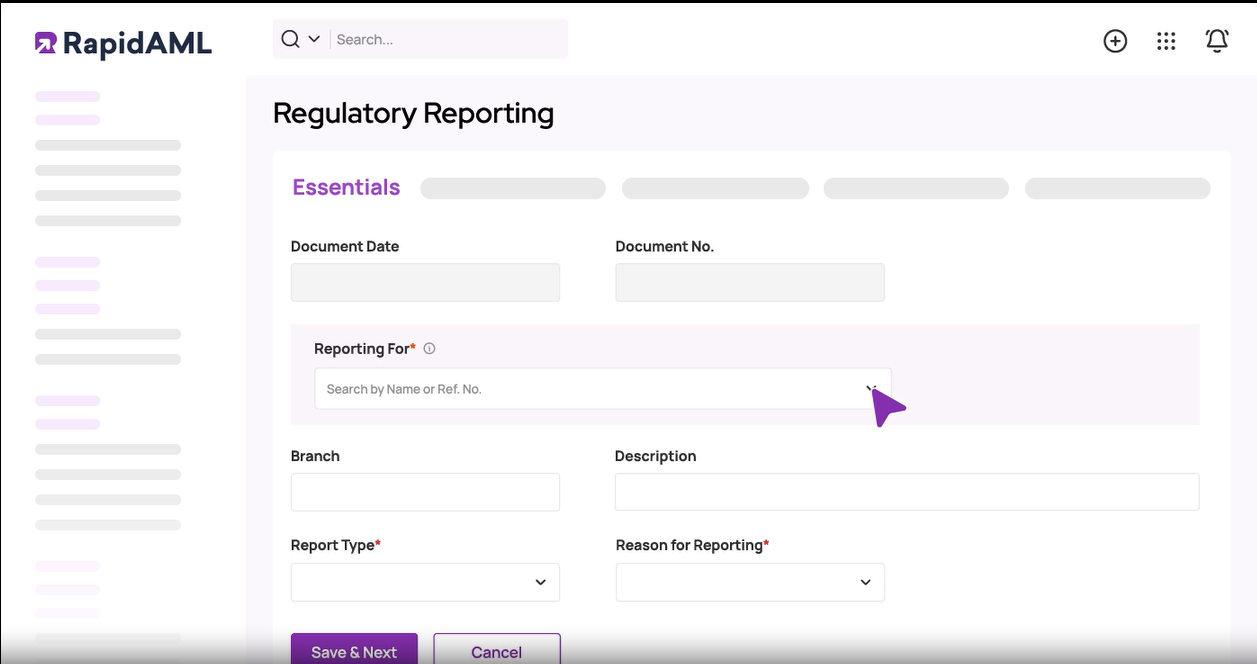

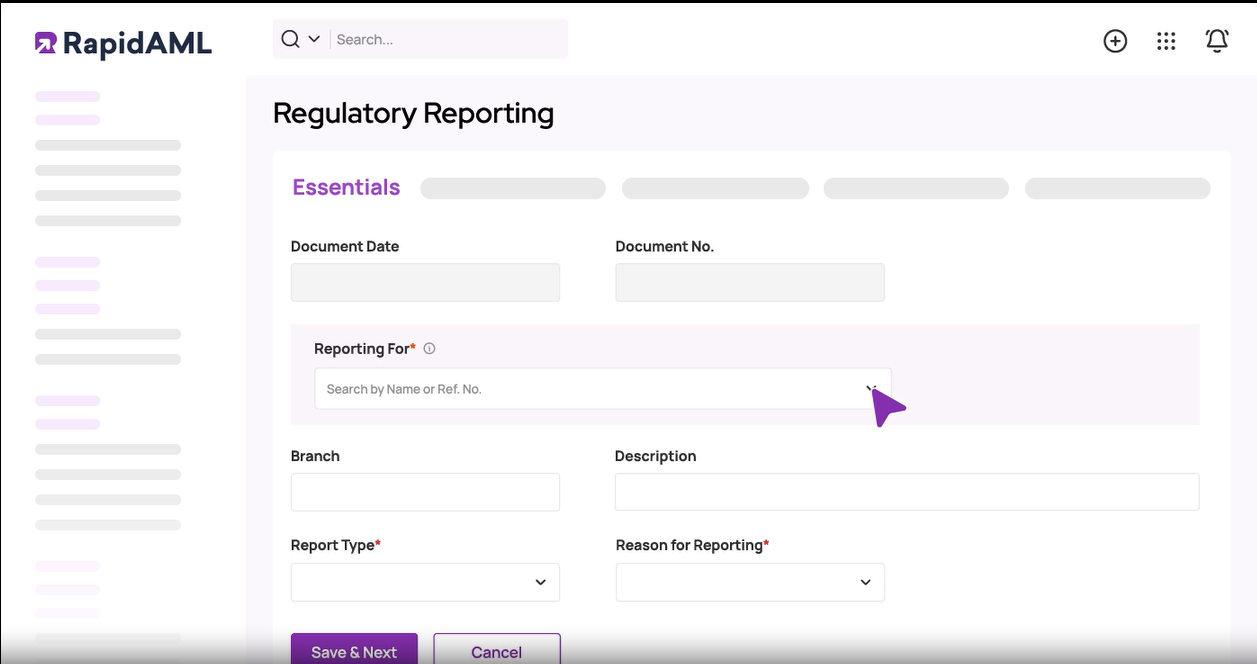

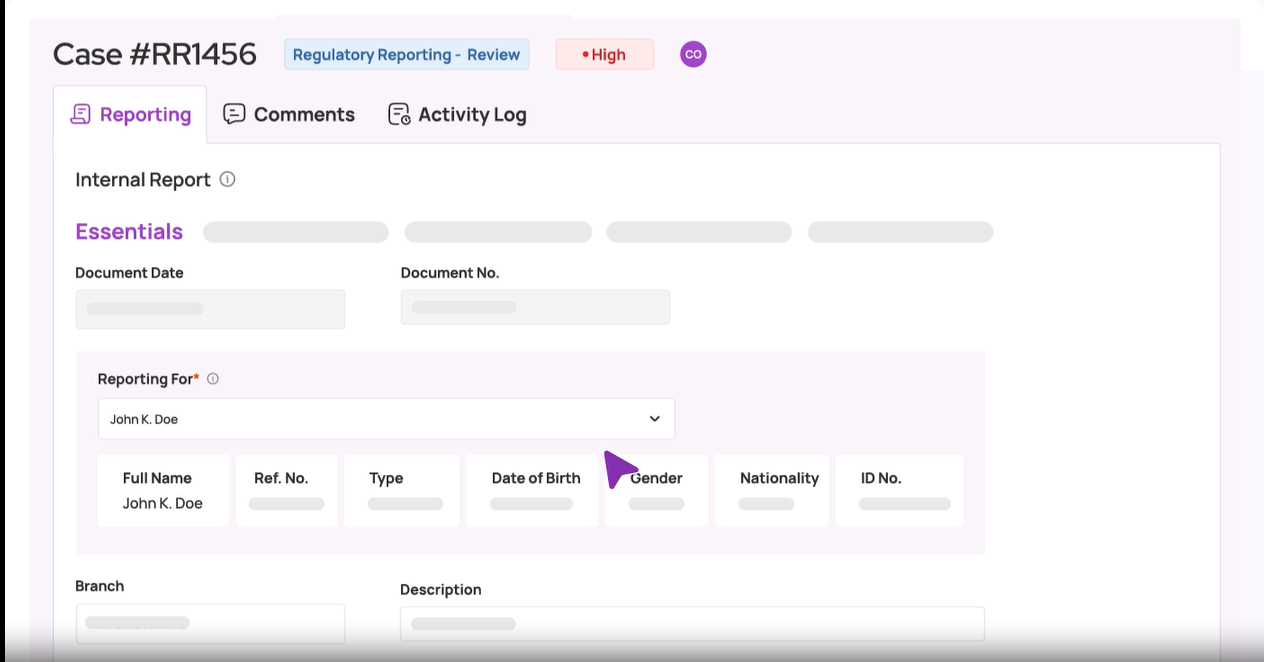

RapidAML is an anti-money laundering software that centralizes financial crime compliance workflows across multiple functions. The platform integrates sanctions screening, PEP checks, adverse media monitoring, case management, KYC verification, customer risk assessment, and regulatory reporting capabilities in one system. RapidAML features role-based access controls, document management with secure storage, automated alerts for document expiry, and re-KYC notifications to maintain compliance standards. The system includes customizable KYC questionnaires and risk parameters to create detailed customer risk profiles. Transaction monitoring functionality enables detection of suspicious activities through configurable rules and automated escalation protocols. The software connects to global watchlists and supports various industries including financial institutions, fintech companies, real estate agencies, and professional service firms that must meet AML regulatory requirements.

Screenshots

Categories

Features

FAQ

RapidAML is an anti-money laundering software that centralizes financial crime compliance workflows across multiple functions. The platform integrates sanctions screening, PEP checks, adverse media monitoring, case management, KYC verification, customer risk assessment, and regulatory reporting capabilities in one system. RapidAML features role-based access controls, document management with secure storage, automated alerts for document expiry, and re-KYC notifications to maintain compliance standards. The system includes customizable KYC questionnaires and risk parameters to create detailed customer risk profiles. Transaction monitoring functionality enables detection of suspicious activities through configurable rules and automated escalation protocols. The software connects to global watchlists and supports various industries including financial institutions, fintech companies, real estate agencies, and professional service firms that must meet AML regulatory requirements.

RapidAML belongs to the AML category.

RapidAML offers features such as Case Management, Compliance Management, Transaction Monitoring.

No, RapidAML does not offer a free trial.

Reviews(0)

Write a reviewRapidAML alternatives

OnBoard

NOW AVAILABLE: OnBoard AI - The Most Advanced Boardroom AI Available Today OnBoard is the leading board management platform purpose built for today s boardrooms to simplify governance, enhance transparency, and elevate director engagement. Trusted by...load more

Tipalti

Tipalti helps SMBs automate accounts payable workflows, especially payment processing and vendor onboarding. Its most used by small businesses in marketing and finance roles. Reviewers highlight global payment support and approval workflows, though s...load more

ProcessGene GRC Software Suite

ProcessGene develops forward-thinking GRC software solutions, designed to serve multi-subsidiary organizations. The company has been acknowledged as a market leader and innovator by the most important analyst firms. Businesses and governments worldwi...load more

LogicGate Risk Cloud

LogicGate's Compliance solution streamlines controls and regulatory compliance management by dynamically connecting controls, risks, assessments, regulations, obligations, exams, and evidence all in one platform, helping organizations save time, redu...load more

Plaid

Digital wealth platforms can increase customer lifetime value with Plaid. Fund accounts instantly and securely while unlocking tailored financial advice that helps customers manage cash flow and understand investments.

Sumsub

Sumsub is the one verification platform for all of your AML compliance needs. With Sumsubs customizable KYC, KYB, AML, Transaction Monitoring and Fraud Prevention solutions, you can comply with AML regulations, protect your business and reduce costs ...load more

SEON. Fraud Fighters

SEON helps financial institutions onboard more good customers, reduce fraud losses, and stay compliantwithout slowing growth. Our real-time fraud detection platform uses digital footprinting, device intelligence, and AI insights to flag risky users b...load more

Shufti

Shufti provides global AML screening against 1,700+ sanctions, PEP, and watchlists, enabling businesses to detect financial crime and meet FATF, GDPR, and global AML compliance standards.

Forestpin Analytics

A data analysis platform for finding irregularities, correlations, and duplications with an easy dashboard view.

Entrust IDV

Onfido, an Entrust company, meets your unique identity verification needs with an end-to-end, AI-powered platform. Simplify identity verification for you and your customer with tailored verification journeys. Choose what you need from our Verificatio...load more