Quadient Accounts Receivable by YayPay

Quadient Accounts Receivable is an automated AR platform that streamlines the entire credit-to-cash process for B2B companies.

What is Quadient Accounts Receivable by YayPay?

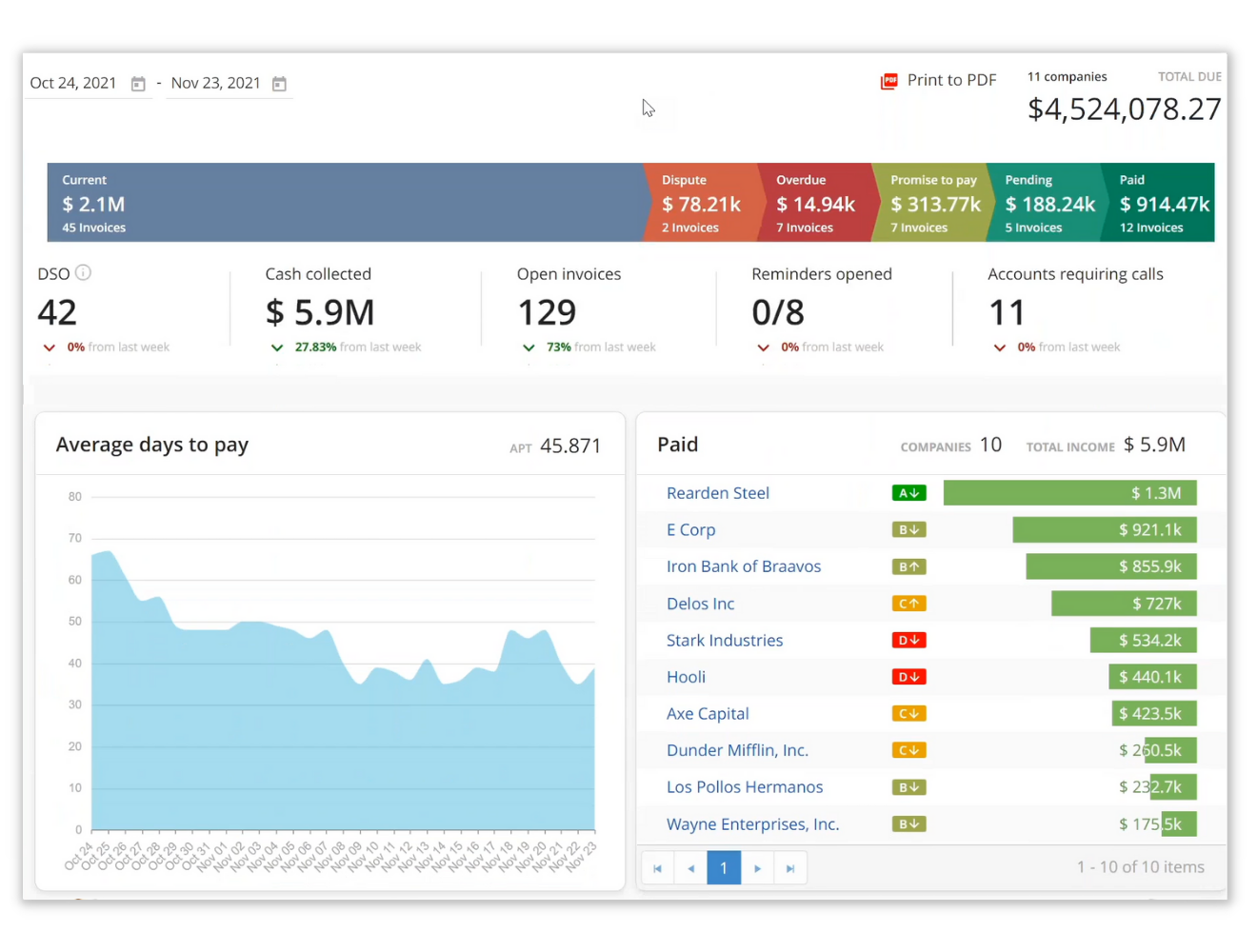

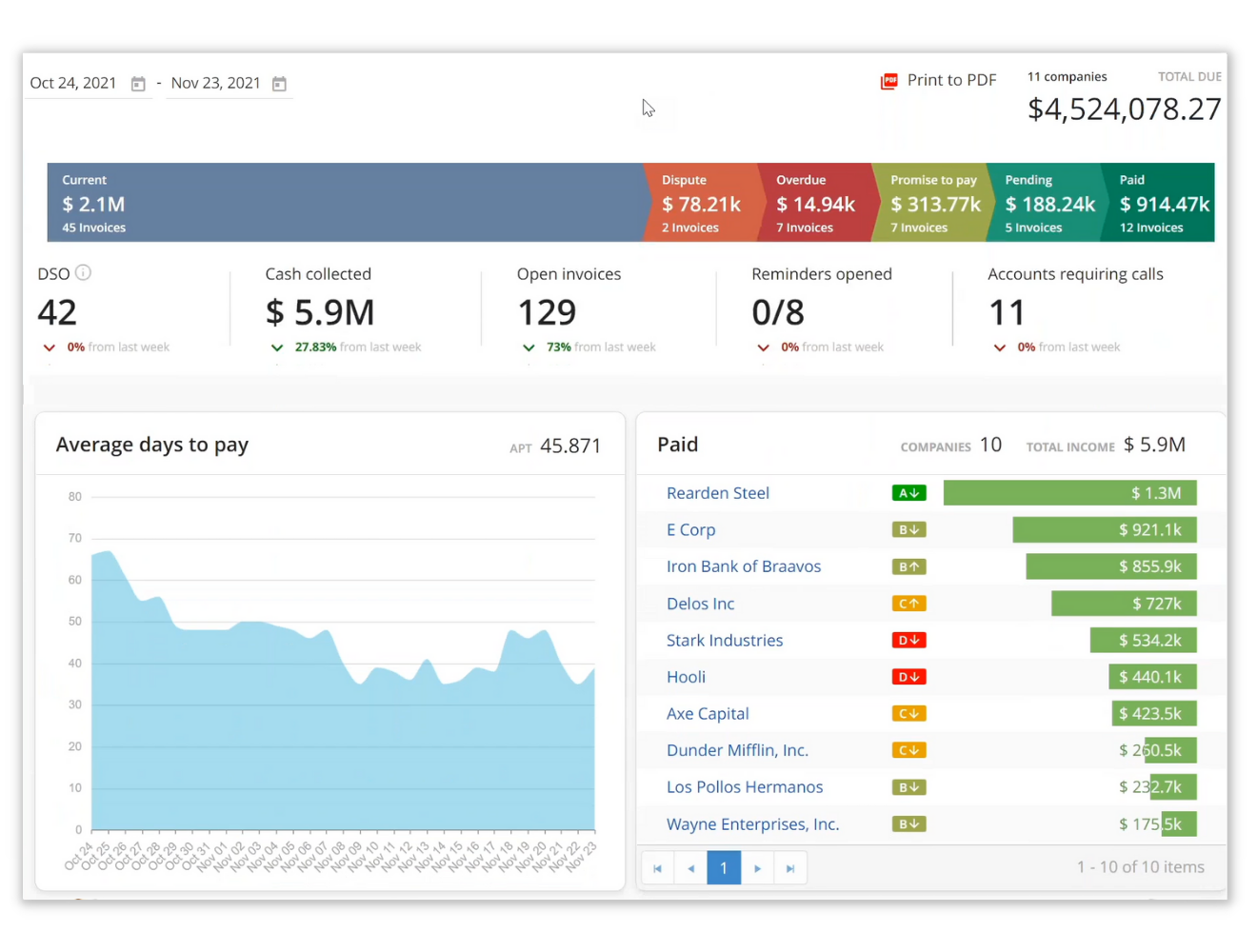

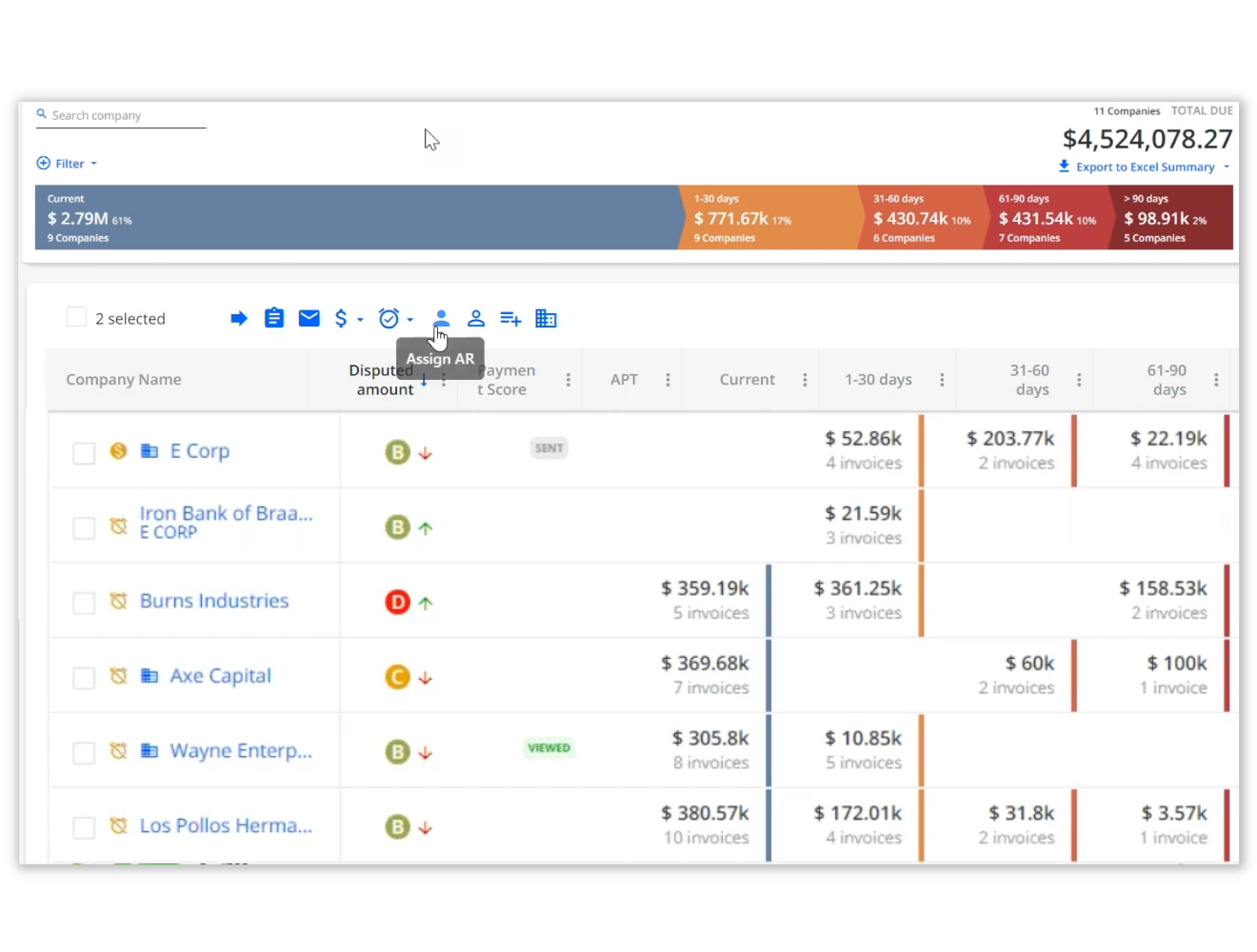

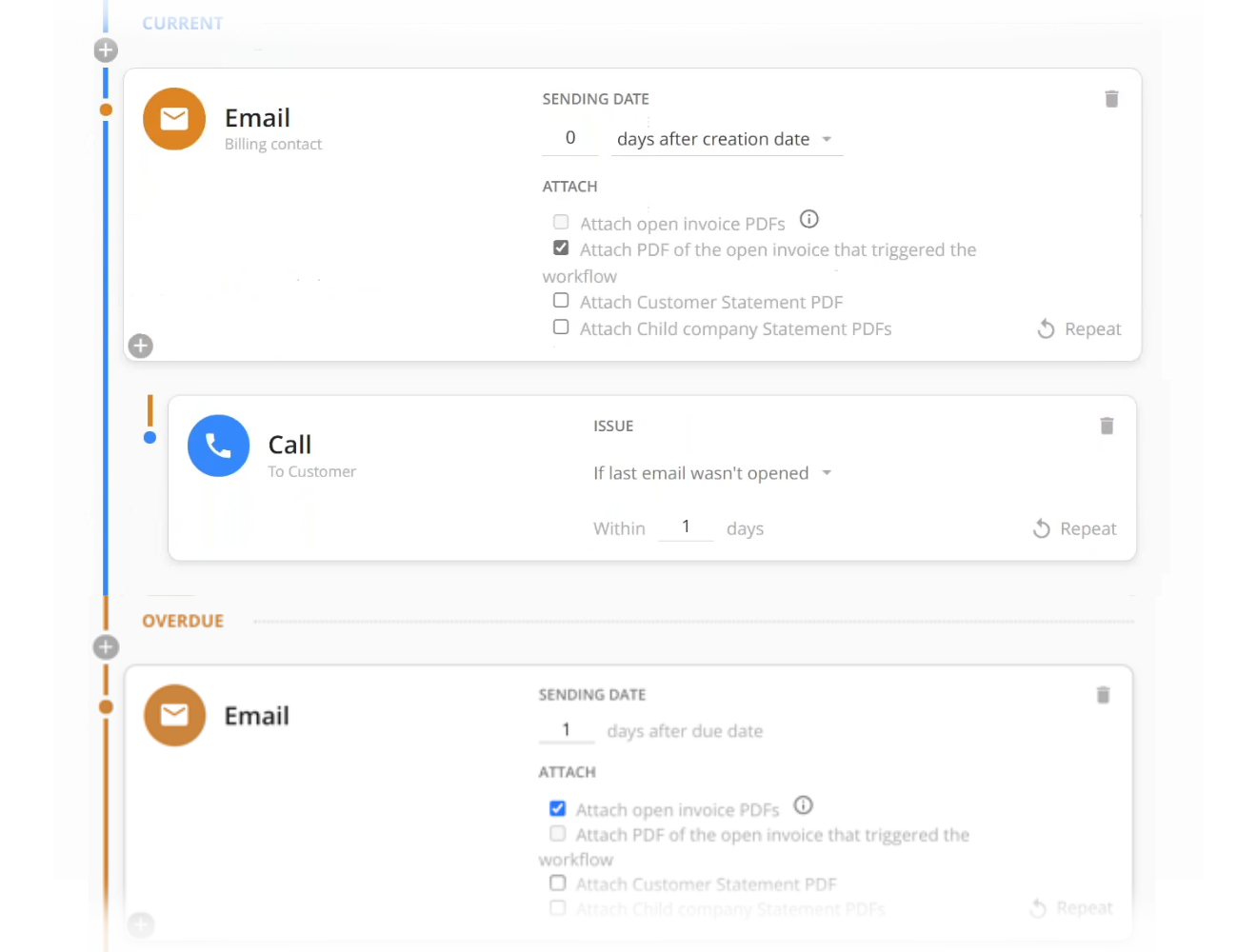

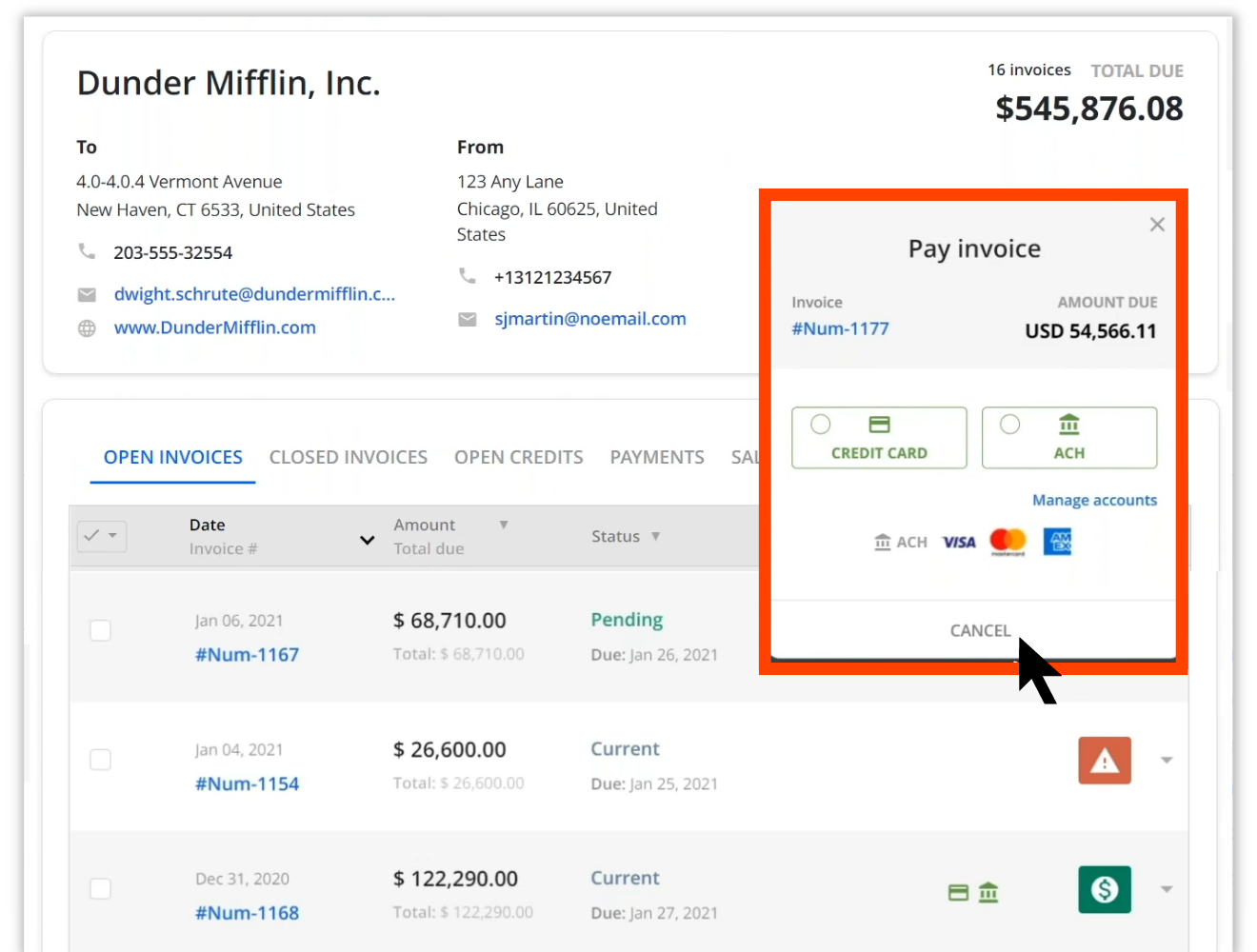

Quadient Accounts Receivable Automation empowers finance teams to streamline collections, accelerate cash flow, and eliminate manual, error-prone tasks. With intelligent workflows and AI-driven prioritization, teams can automatically personalize outreach, follow up with the right customers at the right time, and apply cash with ease. A secure, self-service payment portal allows customers to view invoices and make payments anytime, anywhere driving faster remittance and a better payment experience. On average, Quadient AR users reduce Days Sales Outstanding by 34%, cut manual AR tasks in half, and achieve up to 94% accuracy in cash flow forecasting. Over four years, the platform delivers an average ROI of 403%, helping finance leaders improve working capital, reduce risk, and create a more resilient receivables process. From real-time dashboards to integrated credit risk assessment, Quadient AR gives your team the tools to collect smarter, not harder.

Screenshots

Categories

Features

FAQ

The official website of Quadient Accounts Receivable by YayPay is https://www.quadient.com/en/ar-automation

Quadient Accounts Receivable Automation empowers finance teams to streamline collections, accelerate cash flow, and eliminate manual, error-prone tasks. With intelligent workflows and AI-driven prioritization, teams can automatically personalize outreach, follow up with the right customers at the right time, and apply cash with ease. A secure, self-service payment portal allows customers to view invoices and make payments anytime, anywhere driving faster remittance and a better payment experience. On average, Quadient AR users reduce Days Sales Outstanding by 34%, cut manual AR tasks in half, and achieve up to 94% accuracy in cash flow forecasting. Over four years, the platform delivers an average ROI of 403%, helping finance leaders improve working capital, reduce risk, and create a more resilient receivables process. From real-time dashboards to integrated credit risk assessment, Quadient AR gives your team the tools to collect smarter, not harder.

Quadient Accounts Receivable by YayPay belongs to the Accounts Receivable, Billing and Invoicing, Business Intelligence, Financial Management, Predictive Analytics category.

Quadient Accounts Receivable by YayPay offers features such as Bank Reconciliation, Billing & Invoicing, Invoice Processing, Online Payments, Payment Collection, Real-Time Data, Third-Party Integrations, Billing Portal, Contact Database, Customizable Invoices, Payment Processing, Dashboard, Data Visualization, Visual Analytics, Accounting, Budgeting/Forecasting, Cash Management, Data Import/Export, Financial Analysis, Financial Reporting, Data Discovery, Forecasting, Workflow Management.

No, Quadient Accounts Receivable by YayPay does not offer a free trial.

Pricing

Starting at:

$500

Free Trial Available

Reviews(0)

Write a reviewQuadient Accounts Receivable by YayPay alternatives

PayPal

PayPal helps businesses manage digital payments, invoicing, and mobile transactions across eCommerce and service workflows. Its most used by marketing, IT services, and retail teams. Reviewers highlight its mobile access and real-time alerts, but pri...load more

QuickBooks Enterprise

QuickBooks Enterprise is a payroll platform used mainly by small businesses in accounting, construction, and retail to manage payroll, invoicing, and reporting. Its standout benefit is the ability to customize and automate financial workflows. While ...load more

QuickBooks Online

QuickBooks Online helps small businesses, especially in accounting, construction, and retail manage accounting, billing, and financial reporting with daily-use tools and mobile access. Reviewers highlight its ease of use and ability to connect with o...load more

Dynamics 365

Dynamics 365 helps manage customer relationships, business operations, and reporting through centralized tools. Its most used by administrative and IT teams in software services and support roles. Its contact database and integrated business operatio...load more

FreshBooks

FreshBooks is built for small businesses that need fast, reliable invoicing and expense tracking. Its most used by marketing and IT services teams logging billable hours. Users highlight its automation and financial clarity, though pricing and custom...load more

Rippling

Rippling is an all-in-one HR and workforce management tool mainly used by small and midsize businesses. It is notable for its global payroll capabilities and the automated onboarding and offboarding functions used to save time. Although its pricing i...load more

Xero

Xero helps small businesses simplify accounting, invoicing, and reporting. Finance and admin teams value its clean interface and flexible reports. While support and budgeting tools have limits, standout features like profit or loss statements and pay...load more

Time Tracker

Time Tracker by eBillity helps SMBs log work hours, manage payroll, and invoice clients with accuracy. Its most used by small businesses in administrative and support roles. Reviewers highlight its mobile access and QuickBooks integration as standout...load more

Square Point of Sale

Square Point of Sale is the POS system ready for whatever you set your sights on. With Square, you can build a POS that makes running your business easier. Sell in-person, online, over the phone, or out in the field. Track customer preferences and fe...load more

Wrike

Wrike is a project management platform used by small businesses in IT services, marketing, and education to manage tasks, workflows, and timelines. Users highlight its dashboards and collaboration tools as standout features, while some cite a steep l...load more